TL;DR

- I’m not sure if quantum computers will ever be useful in real life.

- But IBM has promised to deploy large-scale quantum computers by 2029.

- ULVAC is the sole Japanese supplier of essential components (coolers) for quantum computers.

- Currently overvalued with a P/E of 20.26x and PEG of 4.05x.

- However, entering after confirming 2026 earnings could yield a 100-200% return over 3-5 years.

Let’s Be Honest: I Don’t Believe in Quantum Computers

I don’t get what’s so great about quantum computers. For 30 years, the technology has been “10 years away from commercialization” and is still stuck in the lab. Google’s Willow chip is 13,000 times faster than a supercomputer? Great. But what do you do with it?

Cryptocurrency mining? Impossible. Financial simulations? Existing supercomputers are sufficient. Drug discovery? That’s 20 years away.

But making money is a different story.

In investing, what matters isn’t “is the technology great?” but “does the market believe it is?” And right now, the market is crazy about quantum computing.

The Numbers Speak: Is the Quantum Computing Market a Bubble or an Opportunity?

Quantum Computing Market Size:

- 2025: $3.52B

- 2030: $20.2B

- CAGR: 41.8%

Dilution Refrigerator Market (Quantum Computer Cooling Systems):

- 2024: $72.6M

- 2031: $193M

- CAGR: 15.0%

Whether it’s a bubble or real, this means money will be flowing until 2030.

Who is ULVAC, and Why Does It Matter?

Basic Information

ULVAC, Inc. (6728.T)

- Listed on the Tokyo Stock Exchange

- Current Stock Price: ¥6,870 (as of Oct 29, 2025)

- Market Cap: ¥338.3B (approx. $2.2B)

- P/E Ratio: 20.26x

- Dividend Yield: 2.39%

Business Structure

ULVAC’s main business is vacuum equipment. They make vacuum chambers and deposition equipment used in semiconductor and display manufacturing. It’s a solid company with a 60-year history.

The Problem: The Core Business is Dying

| Item | FY2024 | FY2025 | YoY |

|---|---|---|---|

| Revenue | ¥261.1B | ¥251.2B | -3.8% |

| Operating Income | ¥29.8B | ¥26.5B | -11.1% |

| Net Income | ¥20.2B | ¥16.7B | -17.3% |

Declining revenue, declining operating income, plummeting net income. This is a classic case of a mature industry stagnating.

An ROE of 7.47% is mediocre. A “good company” should have over 10%, but ULVAC is just average.

But in March 2025, Everything Changed

The IBM-ULVAC Partnership Announcement

On March 20, 2025, IBM announced ULVAC as its official quantum computer cooler partner.

Why are coolers so important? Quantum computers only operate at -273°C (near absolute zero). To maintain the quantum state of a qubit, extreme cold is essential.

How difficult is this? It’s colder than outer space. A temperature naturally impossible on Earth.

This is why a Dilution Refrigerator is needed. This device:

- Accounts for 30-40% of a quantum computer’s price.

- Costs $2-6M per unit.

- Is manufactured by fewer than 5 companies worldwide.

ULVAC has entered this market with its 60 years of cryogenics expertise.

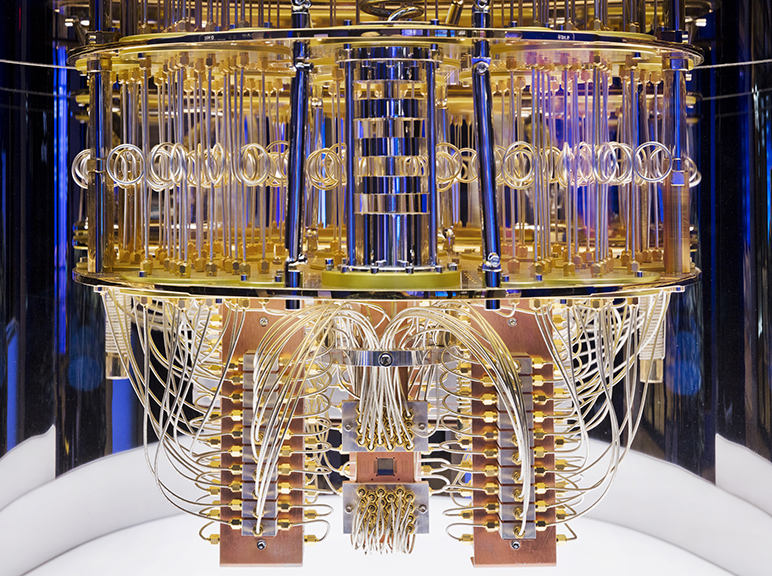

Image Description: The entire chandelier-like gold structure is the ‘Dilution Refrigerator’. The small square at the very bottom is the quantum chip (Quantum Processor), where quantum computations are performed. The gold cooling structure and the chip together form one quantum computer.

IBM’s Roadmap: What Happens by 2029?

IBM is the sole commercial leader in quantum computing. Other companies (IonQ, Rigetti, D-Wave) are still in the experimental stage. IBM is the only company actually selling systems for money.

IBM Quantum Computer Deployment Plan

2025:

- Launch of Quantum + HPC integrated tools.

- Currently operating 13 utility-scale quantum computers.

2026:

- First demonstration of scientific quantum advantage.

- Deployment of error-correction modules.

2027:

- 1,000+ qubit systems.

- Achievement of 10,000 gate-scale operations.

2029:

- Launch of Quantum Starling.

- 200 logical qubits.

- 100 million quantum gate operations.

- The world’s first large-scale fault-tolerant quantum computer.

2033 and beyond:

- 2,000 logical qubits.

- 1 billion gate operations.

How Many Coolers Will Be Sold? (Time for a Calculation)

IBM System Deployment Estimation

Since 2016, IBM has deployed 80 systems worldwide, accounting for over 60% of all quantum computers globally.

Next 5-Year Forecast:

| Year | System Quantity | Cooler Demand | Unit Price | ULVAC Revenue |

|---|---|---|---|---|

| 2025-2026 | 25-30 units | 20-30 units | $2-3M | $40-90M |

| 2027-2028 | 40-60 units | 30-50 units | $2-3M | $60-150M |

| 2029-2030 | 80-100 units | 50-80 units | $2-4M | $100-320M |

| 2031-2033 | 150-200 units | 100-200 units | $2-3M | $200-600M |

Change in ULVAC’s Revenue Mix

ULVAC’s current revenue is ¥251.2B (approx. $1.65B).

With the addition of the quantum cooler business:

- 2026: +$50M (3% of total)

- 2027: +$100M (6% of total)

- 2028: +$150M (9% of total)

- 2029: +$250M (15% of total)

- 2030: +$400M (24% of total)

Even if the existing business declines by -3.8%, the quantum cooler business can turn the overall growth rate positive.

Current Valuation: Overvalued or Undervalued?

Key Metrics (as of Oct 29, 2025)

| Metric | Value | Assessment |

|---|---|---|

| P/E Ratio | 20.26x | High for a mature company |

| P/B Ratio | 1.514x | Fair relative to assets |

| P/S Ratio | 1.35x | Undervalued relative to sales |

| PEG Ratio | 4.05x | Overvalued relative to growth |

| ROE | 7.47% | Low (ideally >10%) |

| Dividend Yield | 2.39% | Stable |

| Debt/Equity | 0.21x | Very low (healthy) |

| Net Cash | ¥52.35B | Excellent |

What a PEG of 4.05x Means

The PEG (Price/Earnings to Growth) ratio measures price relative to growth.

- PEG < 1.0: Undervalued (good buying opportunity)

- PEG 1.0-2.0: Fairly valued

- PEG > 2.0: Overvalued

ULVAC’s 4.05x means the current stock price does not reflect its growth potential.

Why?

- Existing business: -3.8% growth.

- Quantum coolers: Earnings not yet reflected (starts in 2026).

The market still sees “ULVAC = a stagnant vacuum equipment company.”

Investment Scenarios: How High Could It Go?

Conservative Scenario (Reaching PEG 1.5x)

Assumptions:

- 15-20% annual growth from 2027-2029 due to quantum coolers.

- P/E ratio increases from 20x to 25-30x.

Result:

- Current Price: ¥6,870

- 2029 Target Price: ¥10,000-12,000

- Expected Return: +45% ~ +75%

Moderate Scenario (Reaching PEG 1.0x)

Assumptions:

- 25-30% annual growth from 2028-2030 from quantum coolers.

- P/E ratio of 25-35x.

Result:

- 2030 Target Price: ¥15,000-18,000

- Expected Return: +120% ~ +160%

Aggressive Scenario (Reaching PEG 0.7x)

Assumptions:

- Rapid growth in the quantum cooler market (higher-than-expected demand).

- 40-50% annual growth from 2029-2030.

- P/E ratio of 35-50x.

Result:

- 2030 Target Price: ¥20,000-25,000

- Expected Return: +190% ~ +260%

Risk Factors: What Could Go Wrong?

Positive Factors

✓ IBM’s Dominance: IBM is the sole leader in commercial quantum computers. IonQ and Rigetti are still experimental.

✓ Japanese Manufacturing Advantage: ULVAC coolers are produced domestically in Japan, ensuring supply chain stability.

✓ Technological Barrier: Dilution refrigerators are extremely difficult to build. New entry is not easy.

✓ Financial Health: Stable with ¥52.35B in net cash and a Debt/Equity ratio of 0.21x.

Negative Factors

✗ Competitor Risk: There are competitors like Bluefors (Finland), Oxford Instruments (UK → sold), and Chinese companies.

✗ Delay in Quantum Commercialization: If IBM’s 2029 target is delayed, demand will also be pushed back.

✗ Decline in Core Business: If the vacuum equipment business continues to decline at -3.8%, it could offset the gains from the quantum business.

✗ High PEG of 4.05x: The current price may have already priced in some expectations.

So, When to Buy?

Now (October 2025): Too Early

Reason:

- PEG of 4.05x is still high.

- First quantum cooler revenue has not been confirmed.

- Core business is struggling (-17.3% net income decline).

Recommendation: Watch

Mid-2026: Optimal Entry Point

Reason:

- FY2026 earnings announcement (expected August 2026).

- First quantum cooler revenue can be confirmed.

- PEG expected to fall to the 2.0-3.0 range.

Recommendation: Actively Buy (Target Price ¥15,000-18,000)

2027 and Beyond: Momentum Investing

Reason:

- IBM Quantum Starling deployment becomes visible.

- Quantum cooler revenue contributes more than 10% of the total.

- The market re-evaluates ULVAC as a “growth stock.”

Recommendation: Hold and Add (Target Price ¥20,000+)

Investment Strategy: 3 Options

Option 1: Conservative Dividend Investing

Strategy:

- Buy now.

- Secure a 2.39% dividend yield.

- Hold for 3-5 years.

Expected Return:

- Dividends: 2.39%/year × 5 years = approx. 12%

- Stock Appreciation: +45-75% by 2029

- Total Return: +57% ~ +87%

Suitable for: Conservative investors seeking stable cash flow.

Option 2: Moderate Growth Investing

Strategy:

- Buy after confirming mid-2026 earnings.

- Enter at a PEG of 2.0-2.5.

- Sell before the IBM Starling deployment in 2029.

Expected Return:

- Entry Price: ¥8,000-9,000

- Target Price: ¥15,000-18,000

- Total Return: +67% ~ +125%

Suitable for: Investors aiming for medium-term growth over 3-5 years.

Option 3: Aggressive Momentum Investing

Strategy:

- Buy in mid-2026.

- Confirm rapid growth in quantum cooler revenue in 2027.

- Sell when PEG reaches 0.7-1.0 in 2029-2030.

Expected Return:

- Entry Price: ¥8,000-9,000

- Target Price: ¥20,000-25,000

- Total Return: +122% ~ +213%

Suitable for: Investors who can tolerate high risk for high returns.

Final Word: You Don’t Have to Believe in Quantum Computers

The bottom line is this:

“I don’t know if quantum computers will save humanity. But IBM will sell 200 systems by 2029, and each one needs a $3M cooler. ULVAC makes those coolers.”

This is investing. It’s not about the future of technology, but about following the flow of money.

I don’t know if quantum computers will change the world. But I’m confident ULVAC will make money from 2026-2030.

And that’s all that matters.

Summary: Action Plan

| Time | Action | Reason |

|---|---|---|

| Now (Oct 2025) | Watch | High PEG of 4.05x |

| Aug 2026 | Check Earnings | First quantum cooler revenue |

| Sep-Dec 2026 | Buy | PEG expected at 2.0-2.5 |

| 2027-2028 | Hold | Confirm revenue growth |

| 2029 | Partially Sell | When PEG reaches 1.0 |

| 2030 | Sell All | Target price achieved |

Target Return: +100% ~ +200% over 3-5 years

Risk Management:

- Allocate no more than 5-10% of your portfolio.

- If 2026 earnings miss expectations, sell (below ¥6,000).

- Re-evaluate if PEG remains above 3.0 in 2027.

References

Company Information

IBM Partnership

Market Outlook

- MarketsandMarkets: Quantum Computing Market Report ($3.52B → $20.2B)

- Valuates: Dilution Refrigerator Market Report ($72.6M → $193M)

IBM Roadmap

Disclaimer: This article is for informational purposes only and does not constitute investment advice. All investment decisions are the sole responsibility of the investor, and the author is not liable for any direct or indirect losses resulting from them.